D-Risk FX Budget & BI

Protégez vos marges

Diminuez vos coûts de gestion

Utilisable dès le premier jour et sans frais d'implantation

Nous vous accompagnons dans la prise en main votre gestion de risque grâce à D-Risk FX Budget & BI.

Solution SaaS d’aide à la décision pour aider les entreprises à se couvrir efficacement et, à suivre et contrôler leur performance anticipée.

Vous vivez les impacts du risque de devises? Vous êtes dans la direction financière – VP Finance, Trésorier, Directeur financier, Contrôleur, etc. –

D-Risk FX vous aide à protéger la profitabilité de votre entreprise de la volatilité et de l’imprévisibilité des marchés.

NOTRE SERVICE

Que faisons-nous ?

TRÉSORISQUES vous offre un service d'accompagnement à l'aide de D-Risk FX Budget & BI, une plateforme infonuagique (SaaS) qui permet aux PME qui font de l’import et/ou export, de suivre en temps réel l’impact du risque de change sur les états financiers de l’entreprise et sa rentabilité.

Modélisation de votre budget

Multi-marchés • Multi-devises • Multi-périodes

Synthèse de vos risques au budget

Analyses détaillées • Simulateur par marché et global

Construire vos stratégies de couverture

Calcul des couvertures requises • Simulations selon votre tolérance • Analyse de divergence • Saisie des transactions de couverture

Suivi de la rentabilité en temps réel

États des résultat Multi-devises • Suivis des écarts • Alertes de recouvertures

Informations en continu pour faciliter une prise de décision efficace et rapide

Les informations sont toujours facilement disponibles pour aider à la prise de décision et agir en conséquence

Un aperçu de D-Risk FX en vidéo

Pourquoi nous?

Pourquoi intégrer la gestion du risque de change aux indicateurs de performance d’un tableau de bord corporatif ?

Parce que le risque de change est une conséquence directe de vos opérations transfrontalières, sa gestion est fondamentale. Elle peut influencer vos décisions stratégiques.

Ce risque peut affecter de façon négative

Les marges de l’entreprise et la rentabilité des opérations

La prédictibilité des flux de trésorerie

L’évaluation de crédit de l’entreprise

La compétitivité de l’entreprise / relations clients

D-Risk FX Budget & BI permet d’éviter de traiter le risque de façon ponctuelle afin d’améliorer la performance de l’entreprise.

Par exemple

- Contrôler le risque de change

- Obtenir quotidiennement une vision claire de votre exposition grâce à la mise à jour automatique des taux de change sur la plateforme

- Déterminer les montants requis de couverture en fonction de votre tolérance au risque et analyser la source des résultats inattendus

- Gérer le risque en fonction de son impact sur les principales variables financières par ligne d'affaires

- Supporter le processus budgétaire de l’entreprise - suivre les résultats et les écarts au budget

- États financiers prévisionnels Multi-devises - suivre et anticiper les tendances de l’entreprise afin de mieux mitiger les risques

Entrer en contact

Nous sommes là pour vous! Comment pouvons nous aider?

Parlons toujours de la croissance de

votre entreprise

Pour nous joindre

Gilles Vigneau, (Président)

NOS ANNONCES

DERNIÈRES NOUVELLES

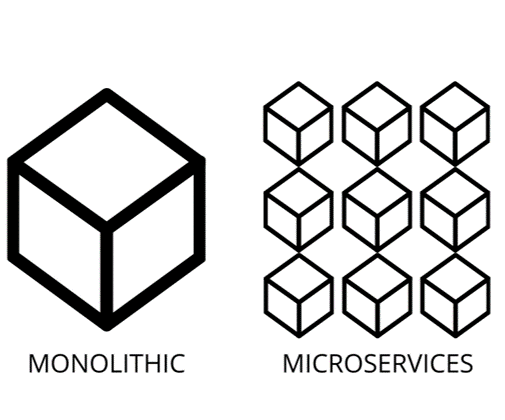

Les fonctions de trésorerie sont et seront modifiées par la transformation numérique. Ces nouvelles technologies transforment la façon dont nous devons envisager la trésorerie et, plus particulièrement, la gestion des risques de devises.

L'inflation, les devises et le système bancaire (SVB, CS) ont maintenu le marché sur ses gardes. En ce qui concerne l'inflation, les banques centrales ont toujours affirmé que l'inflation s'estomperait rapidement, et il semble qu'elles aient eu raison.